Investor Relations

Initiatives to promote understanding and build trust on the part of shareholders and investors

Information disclosure policy

Hioki has adopted the following basic policy on disclosing information to shareholders and investors: “Hioki is committed to disclosing information in a timely, fair, and appropriate manner to facilitate understanding, trust, and the ability to fairly evaluate the company’s operations on the part of all stakeholders, including shareholders and investors.”We comply with the Timely Disclosure Rules put in place by the Tokyo Stock Exchange. We also work to disclose information that does not technically fall under those rules when we believe it could be of use to stakeholders or the general public, and we do so quickly and accurately based on considerations of fairness and timeliness.

Dividend policies

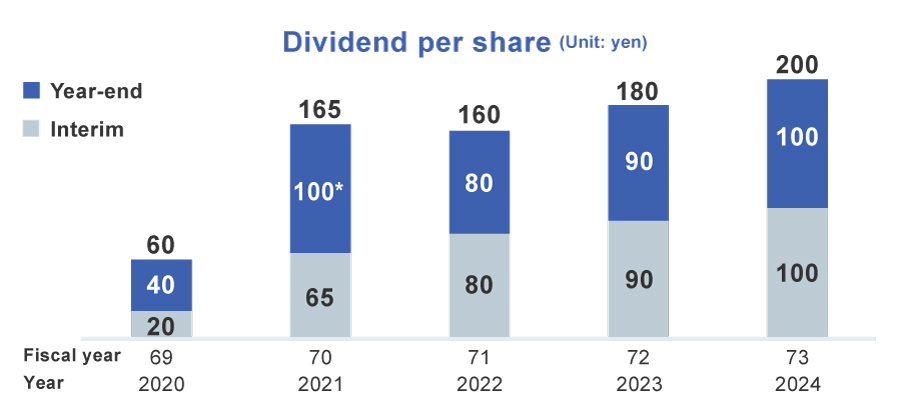

Regarding profit distribution to shareholders, we intend to implement enhanced profit returns through improved performance based on aiming for a consolidated payout ratio of 40%. Additionally, even in cases where performance deteriorates due to temporary factors, we will strive to maintain stable dividends based on the dividend rate of shareholders' equity.

Our basic policy is to distribute surplus funds twice a year through interim dividends and year-end dividends.

*Includes a dividend of 30 yen to commemorate the 30th anniversary of Hioki’s initial public offering.

*Includes a dividend of 30 yen to commemorate the 30th anniversary of Hioki’s initial public offering.

Financial briefings and website initiatives

We hold two financial results briefings each year (after the second quarter and at the end of the year) for institutional investors and securities analysts to help them understand Hioki’s performance and future corporate strategies. We also work to deepen investors’ understanding of our operations and of the electrical measuring instrument industry by responding promptly to inquiries from investors and journalists. We strive to ensure these provide opportunities for direct dialogue, allowing stakeholders to ask questions and share their perspectives.

Our IR Information page is regularly updated to provide the latest information.

The page features detailed information about our shares, our Medium-term Management Plan, and a variety of reports, including financial summaries, securities reports, annual and interim reports, and materials from financial briefings.

General meeting of shareholders

Every year at the end of February, we host our General Meeting of Shareholders at Hioki Hall on our headquarters campus in Ueda. This meeting also includes a company update, providing attendees on the latest developments. During this session, the president provides an overview of key developments from the past year, outlines future business strategies, and explains the initiatives we’re undertaking to achieve our goals. A Q&A session is also held to encourage interaction.